Dutch gas production still in decline in 2023

The Dutch government presented a North Sea gas production acceleration plan on 15 July 2022. The current cabinet's outline agreement also mentions scaling up gas production in the North Sea. The acceleration plan aims to increase gas production in the North Sea to promote security of supply of gas in the Netherlands and thus partially compensate the lack of Russian gas imports.

The latest figures show that realised and expected Dutch gas production is continuously lagging. This is shown in an analysis by TNO.

State of gas production

TNO annually evaluates the state of gas production for the Ministry of Climate and Green Growth ‘Natural and geothermal resources in the Netherlands’.

- In the entire year of 2023, 10% less gas was produced than expected at the beginning of the year in the Netherlands.

- Gas resources onshore and offshore dropped tremendously in the Netherlands: from 97 to 74 billion m3 in 2023.

- Few exploration wells for possible new gas fields are foreseen in the coming years, this is similar to the UK trend.

- If the decline continues, North Sea gas production may become minimal after 2030.

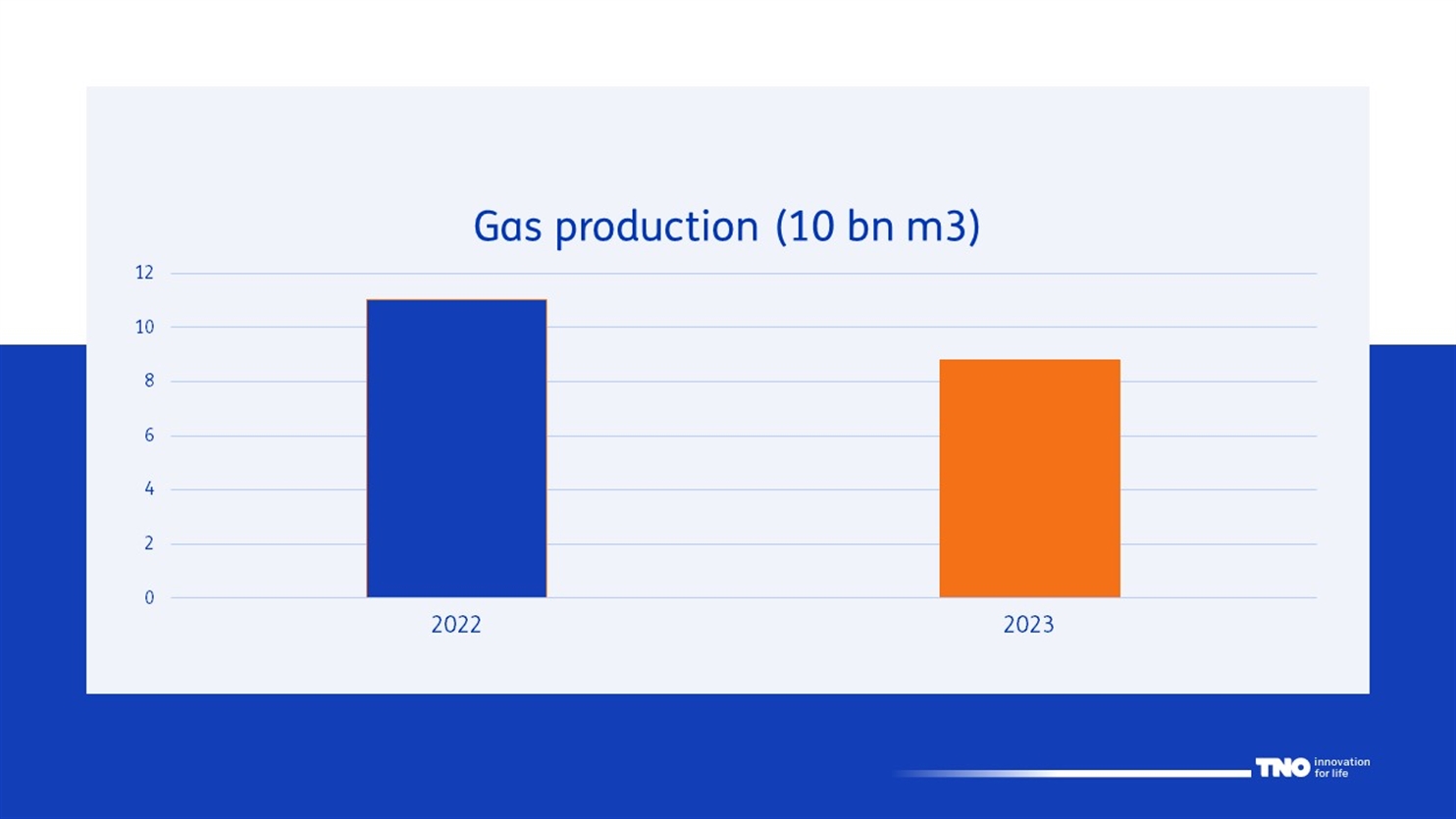

Expected and realized gas production

In 2023, 8.8 bln. m3 of gas was produced, which is 10% less than the expected 9.8 bln. m3 of gas from the ‘small fields’ (all gas fields without the Groningen gas field)1. Gas production in 2022 was also lower than expected, at 11 bln. m3, while at the beginning of the year gas companies had expected gas production of 12 bln. m3. Thus, gas production fell by 20% from 2022 to 2023.

Decrease in gas resources from 2022 tot 2023

The gas producers have depreciated the expected gas production from proven gas fields for the next decades by 14 billion m3 (from the gas stockpile). This adjustment has, along with gas production, reduced the total gas resources in the Netherlands 97 to 74 billion m3 over 2023. Therefore, future annual production will be lower.

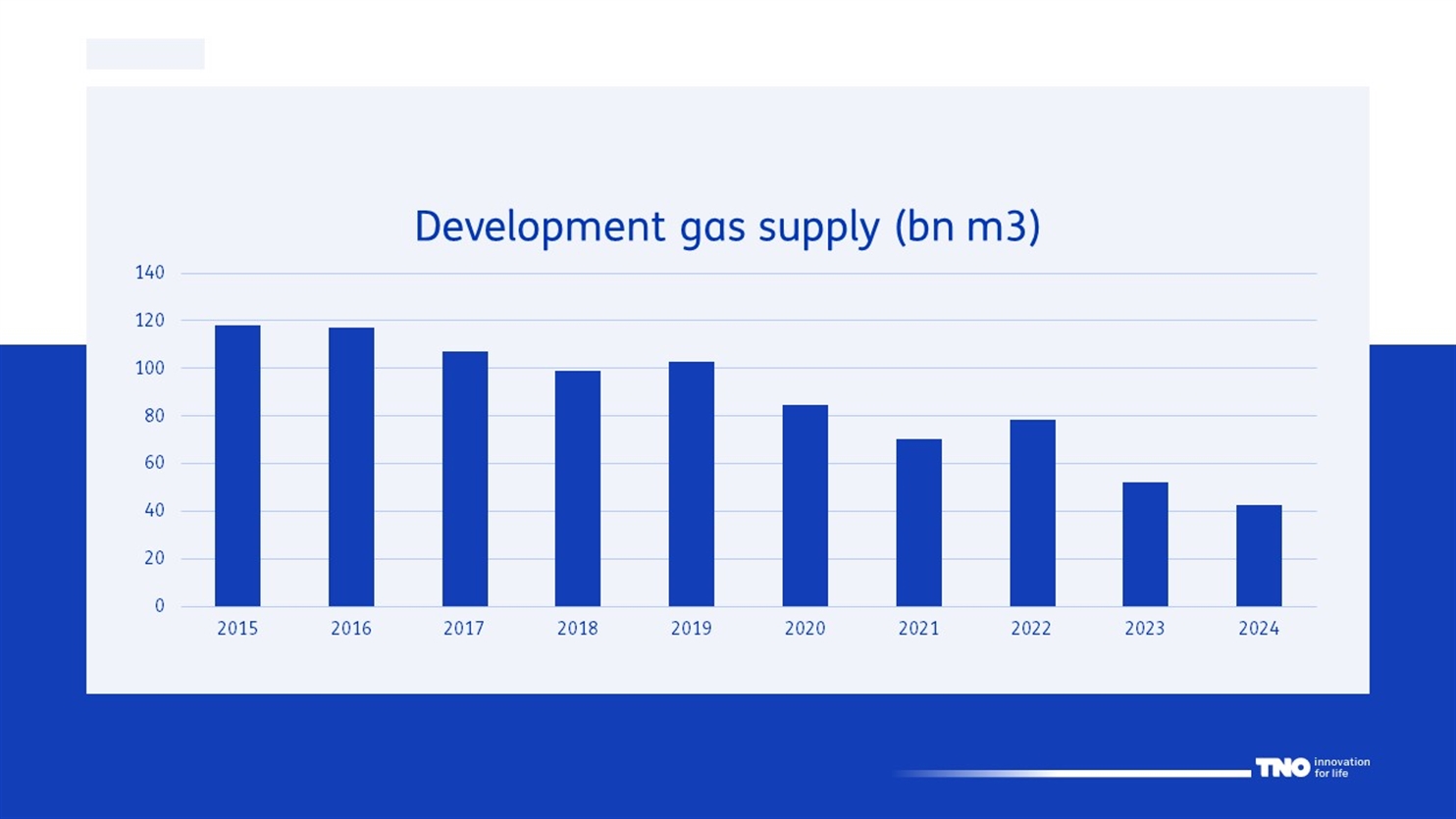

Long term decrease gas resources

Over the past 5 years (2019 to 2023 ), gas producers have written off expected gas resources by an average of 9 bln. m3 annually. Total gas resources have decreased due to both these write offs and production.

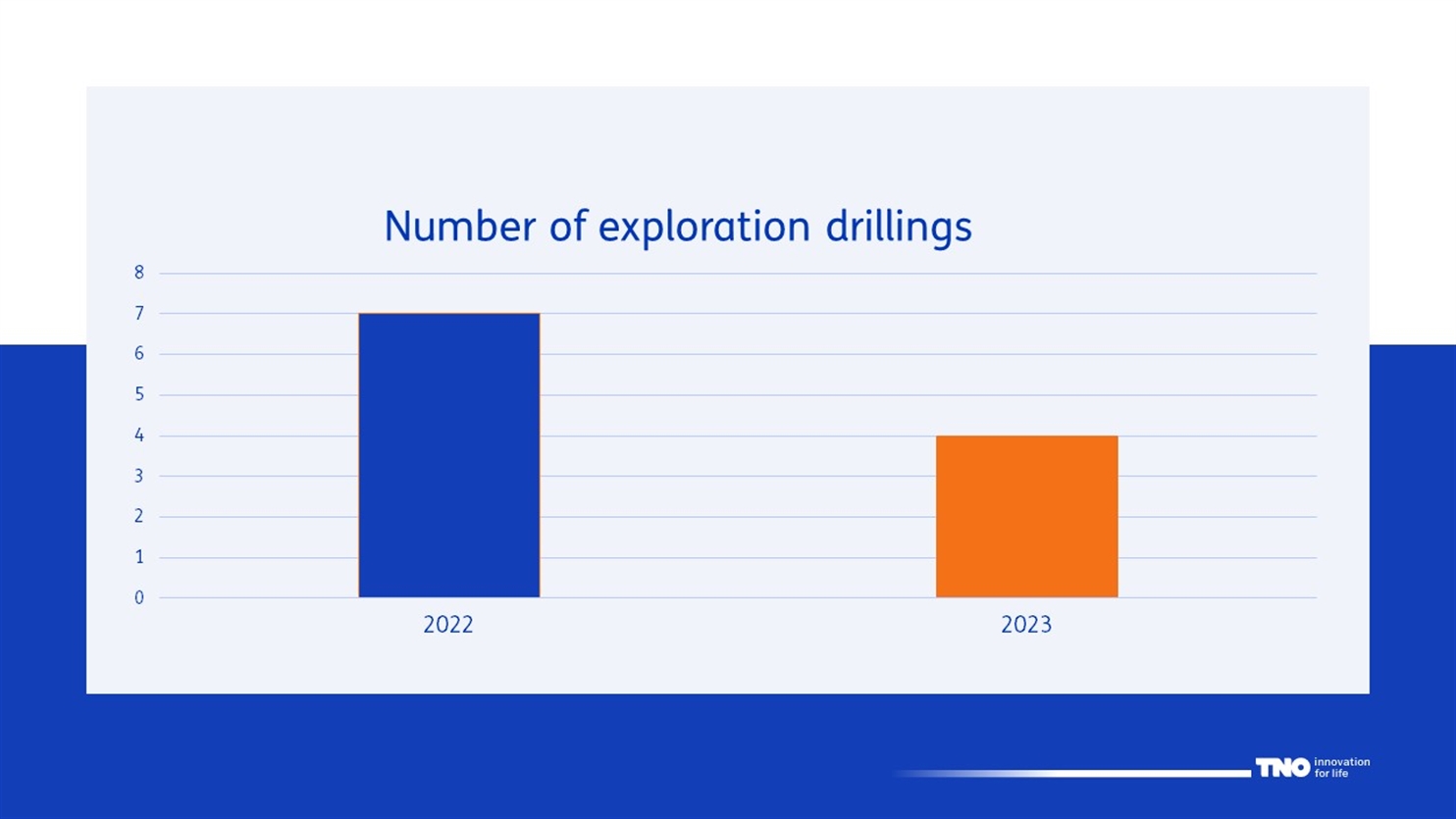

Number of exploration wells

There were four exploration wells in the North Sea in 2023, down from seven in 2022. Few formal plans have been put into contracts for the coming years.

Expected decrease

The aim of the acceleration plan is to promote gas production to counter declining gas production. The decline has accelerated over the past 5 years. Based on this trend, TNO foresees a continuation of the decline. If the trend continues, gas production will be minimal around 2030. Gas producers still see potential beyond 2040.

Potential causes

The projected numbers of exploration wells (from 7 to 4), gas reserves (from 97 to 74 bln m3) and gas production (from 12 to 9 bln m3) all show that after almost 2 years, no effects of the acceleration plan have matured. A decrease in production due to depletion of gas fields is expected, however depreciation of gas resources and the low investment readiness are characteristic. They indicate that the Netherlands has become less attractive for investments by the oil and gas industry. Overall, it seems that there is a worsened perception of the investment climate in the Netherlands among gas producers. This is possibly caused by:

- The additional taxes for gas producers following the extremely high gas prices in 2022.

- Delays due to licensing procedures (ref. NO5-A process).

- A decrease in new (realized) projects due to public opposition to onshore and offshore gas production.

- The uncertainty about social acceptance (and thus political support) means that investing in gas production projects carry a higher financial risk.

Currently, due to the new government in the UK, projects in that country are also expected to become less attractive. This, together with policies yet to be implemented, may result in the Netherlands becoming relatively more attractive again.

Accountability

TNO annually evaluates the state of gas production with the annual report ‘Natural and geothermal resources in the Netherlands’. This annual report is compiled by the Advisory Group for Economic Affairs (TNO-AGE, part of the Geological Survey of the Netherlands - GDN). The basis of the evaluation is formed by data received from operators under the Mining Act. TNO-AGE does this commissioned by and for the Ministry of Climate and Green Growth (formerly Economic Affairs and Climate)). The annual report provides an overview of the activities and results of hydrocarbon, rock salt and geothermal exploration and production in the Netherlands. It also discusses the status and future of subsurface storage (natural gas, oil and nitrogen) and permanent (salt water and CO2) storage.

The Geological Survey of the Netherlands (part of TNO) manages all data and knowledge of the Dutch subsurface. One of its tasks is to advise on the extraction of gas from the Dutch subsurface. The GDN has been doing this for decades and reports on this annually (see also www.nlog.nl).

Get inspired

Labtour RCSG

Innovate subsurface technologies

Novel drilling technology to accelerate the heat transition

Advancing geo-energy technologies for the energy transition

Limited growth in geothermal energy production in 2023 but a record number of drilling operations