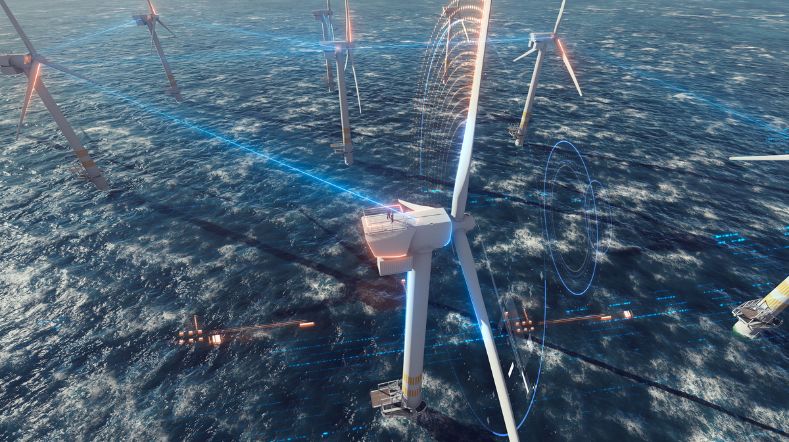

Maximising the value of wind energy in the future energy mix

The tremendous growth of wind as a renewable energy source, its conversion into hydrogen, other energy carriers, and expanding storage options are going to change the playing field significantly in the coming decades. For developers of wind farms, it is crucial to understand how all these changes will influence their business case. TNO is an independent party that studies how government objectives for wind energy can be profitably achieved by the market

Solid business case wind farms from technology point of view

To maximise the value of large volumes of wind energy in the future energy system, we need to ensure sustainable business cases for developers up to 2030 and 2050. There are many variables involved in investing in wind farms. Not only will more energy be generated in future; new combinations of solar and wind farms, as well expanding conversion and storage options, are also at play.

It is also still highly unclear how much wind energy will need to be incorporated into the energy system, transferred to industry as electricity, converted into hydrogen, or stored. This integration will affect the prices in the energy mix, which in turn affect developers’ business cases. TNO is investigating which aspects will play a role in the short and longer term, and to what extent. To this end, we have developed tools and models that can predict future developments, thus enabling developers to build a solid business case.

Energy market response to fluctuating winds

Variable renewable energy sources, such as wind energy, will significantly change the behaviour of the energy market. Prices will be more volatile due to fluctuations in supply and demand. The production of hydrogen will inevitably impact prices in the electricity market and there will be merit order changes. There will be uncertainties due to alternating periods of surpluses and shortages of green energy. At the same time, falling technology costs and heightened market integration are making investing in renewable energy sources increasingly interesting.

Potential business cases are also emerging for wind farms that are connected to resources that increase their flexibility (such as battery storage and hydrogen conversion). These developments can reduce price volatility in the market by smoothing out peaks and troughs, resulting in less renewable energy being lost. TNO is looking at how the wind can be profitable in different electricity markets like day-ahead, intraday, and imbalance, using revenue stacking models and power market and analysis tools.

Models and analyses

To provide insight into the interaction between future markets, TNO is modelling future scenarios that show how they could react. Our cost model, for example, is used to estimate existing and future developments, and thus predict how they will affect investments for wind farm developers and operators through the Levelized Cost of Energy (LCoE), Hydrogen (LCoH), and Storage (LCoS).

In addition to using it to develop markets, we are using this cost model to study the effects of technological changes that affect wind farms, such as direct-drive turbines or floating structures. We are also calculating the optimal combination of different assets, usage, and sizing. These include wind and solar energy generation, conversion to hydrogen, battery storage, and heat production. Our modelling and analysis of future markets (both for electricity and hydrogen) and combined assets can help stimulate the further rollout of renewable energy.

Holistic energy system design

In the joint industry project FLEXH2, we are collaborating with industrial and knowledge partners on the integration of offshore wind energy and hydrogen production. Integrating large amounts of variable renewable energy requires a holistic design of the energy system and technological innovations to avoid overloading the power grid. In this area, TNO is primarily focused on the integrated design, operation, and optimisation of the system.

Get inspired

Smart Energy Networks & Grid Solutions

The energy system of the future

Smart networks for a future-proof energy system

TNO and Jungle AI collaborate to detect cyberattack on wind turbine and improve detection capabilities

Wind energy webinars